European Central Bank raises interest rates to record highs for 1Oth time in a row

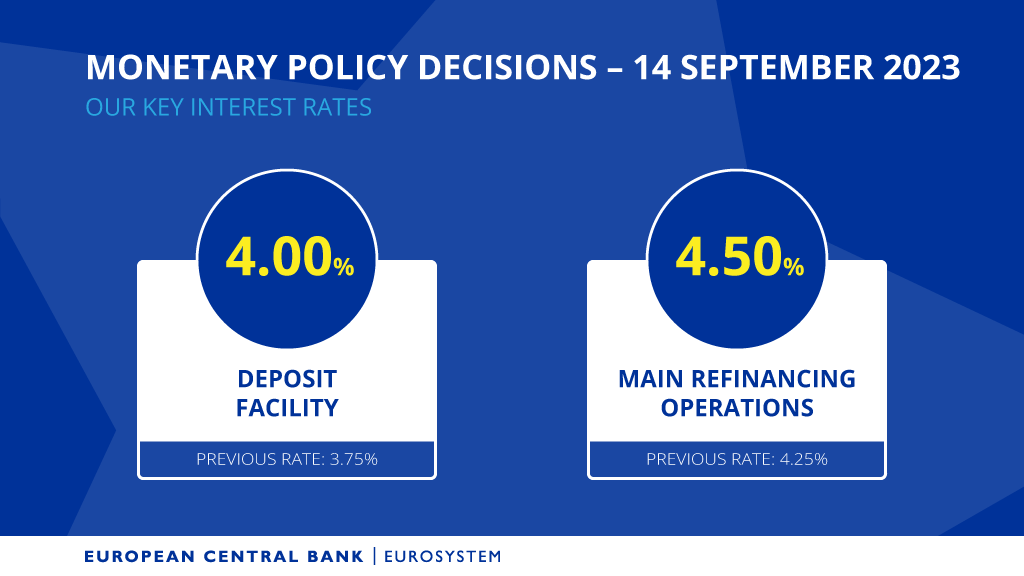

The European Central Bank announced it would raise interest rates by 25 basis points on Thursday afternoon, making it the 10th increase in a row. The primary interest rate now stands at 4.5 per cent. The deposit rate rose to 4 per cent, its highest level ever, while the euro slipped to a three-month low.

"Inflation is continuing to decline but is likely to remain too high for too long," the ECB said in a press release.

"On the basis of its current assessment, the Governing Council considers that the key ECB interest rates have reached levels which, if maintained for a sufficiently long period, will contribute significantly to the timely return of inflation to its objective."

Inflation is expected to decline slowly based on predictions by the ECB's economists. For the rest of this year, they expect 5.6 per cent, compared with 5.4 per cent in the previous projection. The inflation expectation for 2024 (3.2 per cent) has also increased, but the estimate for 2025 is lower (2.1 per cent).

Economic activity

"The upward revisions for 2023 and 2024 are mainly related to a higher path for energy prices." By definition, the ECB aims for inflation of 2 per cent in the medium term. Furthermore, it expects economic growth of 0.7 per cent in 2023, followed by 1 per cent in 2024 and 1.5 per cent in 2025. The growth outlook is therefore much lower.

Higher policy rates will likely make bank loans more expensive and thus slow the economy. This should reduce demand and quell inflation. It remains to be seen whether the ECB leadership will decide to raise interest rates again. Analysts were divided in their forecasts.

The refinancing rate, traditionally considered the key interest rate banks pay to borrow from the ECB, rose to 4.5 per cent. In the past, the refinancing rate was only higher once, in October 2000 (4.75 per cent), when it was defined differently. From May 2001, the rate was also 4.5 per cent for several months.

Deposit rates are rising to their highest level ever. This rate had been negative for years to encourage banks to pump money into the economy. The rate on short-term ECB loans to banks will rise to 4.75 per cent, but this rate has been even higher in the past.

President of the European Central Bank Christine Lagarde © PHOTO KIRILL KUDRYAVTSEV / AFP

Related news